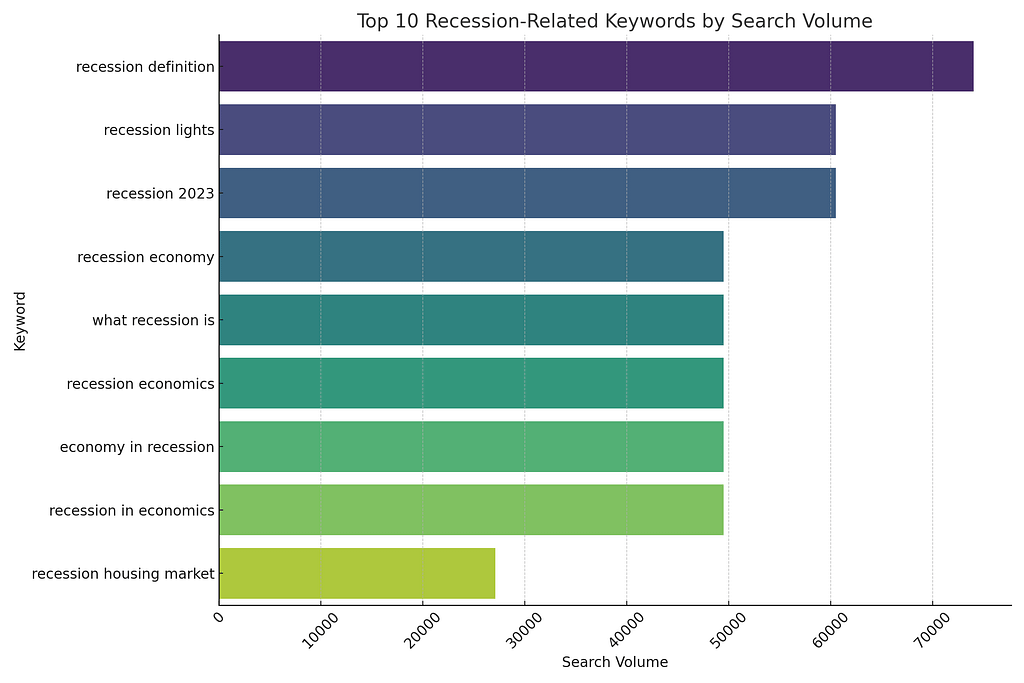

In today's volatile economic climate, the term "recession" has become a buzzword that has captured the attention of not just economists and policymakers but also the general public. With search queries like "recession definition," "recession 2023," and "recession economy" seeing a surge in volume, it's evident that there is growing apprehension surrounding the subject. This quick guide aims to shed a little light on what a recession entails, its multi-faceted impact on different sectors, and the looming fears and speculations about a 2023 recession. Additionally, we'll explore investment avenues that people turn to as safety nets during these uncertain times.

Breaking it Down: What Exactly is a Recession?

Often described in economic jargon, the term "recession" can be intimidating. But in its essence, a recession is a period of marked economic decline that lasts for a significant duration. Typically, it's identified by two consecutive quarters of negative GDP growth. In simpler terms, a recession is a period when the economy hits the brakes—jobs become scarce, businesses shutter, and consumer spending nosedives which causes economic hardships for most people. In short, it's not a very nice time if you don't have a plan to weather the storm in the midst of uncertainty.

Recognizing The Red Flags: Indicators of A Looming Recession

Understanding the early warning signals, often referred to as "recession lights," can provide a window into the future. These indicators can include:

- A drop in consumer confidence

- Rising unemployment rates

- A stagnant or declining housing market

- Volatility in stock markets

- Pessimistic business forecasts

If you've noticed at least three of these indicators in the media, it's a sign that something nasty could be coming your way, and you'd be better off trying to get ahead of the storm, instead of doing nothing about it.

How Does A Recession Impact The Economy?

When a recession occurs, its ripple effects are felt across various sectors of the economy. Employment opportunities shrink, leading to higher unemployment rates. Consumer spending, a crucial driver of economic activity, also declines significantly. Consequently, businesses, especially those reliant on consumer spending, find it challenging to sustain operations. Government revenues decrease due to lower tax collections, leading to potential cutbacks in public services, and a potential government shutdown.

A government shutdown is a situation where Congress fails to pass funding legislation that the President signs into law. When this occurs, federal agencies stop all non-essential work, and millions of federal employees, including military personnel, don't receive their paychecks. If Congress doesn't pass a funding plan by October 1, a shutdown will begin at 12:01 a.m. the next day.

Who's Affected?

- Federal Employees: Around 2 million military personnel and another 2 million civilian workers won't receive their paychecks.

- Businesses: Those closely tied to the federal government, like contractors and tourist services near national parks, could see disruptions.

- General Public: Expect delays in services like clinical trials, firearm permits, and passport applications. Even the travel sector could lose around $140 million daily.

- Financial Markets: Experts warn that a shutdown could rattle the markets. Goldman Sachs estimates a 0.2% reduction in economic growth for every week the shutdown lasts.

The Political Landscape

The shutdown is mainly due to a divide in Congress, with the Republican-led House pushing for deep spending cuts. The disagreement could make the shutdown last for weeks. Even former President Donald Trump is fueling the fire by supporting the hardliners.

What's Exempt?

Some government entities like Social Security will still operate, and essential employees like air traffic controllers will continue working. Court cases, including those against Donald Trump and Hunter Biden, will proceed as they are funded through other means.

How Does It End?

Congress must agree on funding, and the President must sign it into law. Often, a temporary extension known as a Continuing Resolution (CR) is passed to keep the government running. However, given the current political climate, even this could be a challenge.

Unpacking Fears of a 2023 Recession

The surge in queries for "recession 2023" points to a palpable sense of dread about the future. Although it's near impossible to predict economic downturns with pinpoint accuracy, several contributing factors are fueling these concerns:

- Ongoing geopolitical conflicts

- Economic aftershocks of the COVID-19 pandemic

- Fluctuating global oil prices

- Domestic political uncertainties

Investment Strategies During Recessionary Times

In the face of a recession, smart investors often pivot their strategies to focus on assets that are considered to be more resilient. These can include:

- Gold: Traditionally seen as a "safe-haven" asset, gold often sees an increase in value during economic downturns.

- Real Estate: Investing in property can be a long-term strategy, especially when prices are low.

- Insurance Policies: These can serve as a financial cushion, providing a safety net against potential losses.

- Bitcoin and Cryptocurrencies: Often referred to as 'digital gold,' Bitcoin and other cryptocurrencies are increasingly viewed as hedges against inflation and economic instability.

Navigating Through A Recession: Practical Tips

Understanding the mechanics of "recession economics" can help individuals and businesses better navigate the rough waters. Some useful approaches include:

- Diversifying income streams to reduce dependency on a single source

- Eliminating or minimizing unnecessary expenses

- Investing wisely in recession-resistant sectors

- Maintaining an emergency fund for unforeseen circumstances

Final Thoughts

As the storm clouds of a possible 2023 recession gather, gaining a comprehensive understanding of what a recession is, its potential indicators, and its multifaceted impacts become increasingly vital. Armed with this knowledge, one can not only weather the storm but also find opportunities for growth and stability.

Disclaimer: This article is for informational purposes and should not be construed as financial or investment advice. Always consult with a qualified financial advisor before making any significant investment decisions.

Matt is the founder of TechMalak. When he's not buried face-deep in the crypto charts you can find him tinkering with the latest tech gadgets and A. I tools. He's a crypto investor and entrepreneur. He uses a mixture of A.I and human thought and input into all his articles on TechMalak, further merging man with machine.