Have you ever wondered how Bitcoin works and why it was created? It's been hailed by some as the currency of the future and dismissed by others as a speculative bubble about to burst. Yet, despite its increasing prominence, many people still struggle to understand what exactly Bitcoin is and how it works. In this article, we will demystify Bitcoin, breaking down its structure and functionality in simple, understandable terms for newcomers to the world of cryptocurrency.

Unraveling the Mystery: What is Bitcoin?

Launched in 2009 by an anonymous developer (or group) known as Satoshi Nakamoto, Bitcoin is a decentralized digital currency. Unlike traditional currencies such as the dollar or euro, it exists solely in the digital realm and is not controlled by any central authority like a government or financial institution. Bitcoin is based on a technology called blockchain, a public ledger containing all transaction data from anyone who uses Bitcoin. Transactions are added to "blocks" or the links of code that make up the chain, and each transaction must be recorded in a block to be considered legitimate.

The supply of Bitcoin is also different from traditional money. There are only 21 million bitcoins that will ever exist, a limit set by Nakamoto. This scarcity is one of the reasons why Bitcoin's value can fluctuate dramatically. Furthermore, Bitcoin can be divided into smaller units known as satoshis. One Bitcoin is equivalent to 100 million satoshis, allowing transactions to be conducted in fractions of a Bitcoin rather than full units.

Digging Deeper: How Bitcoin Works

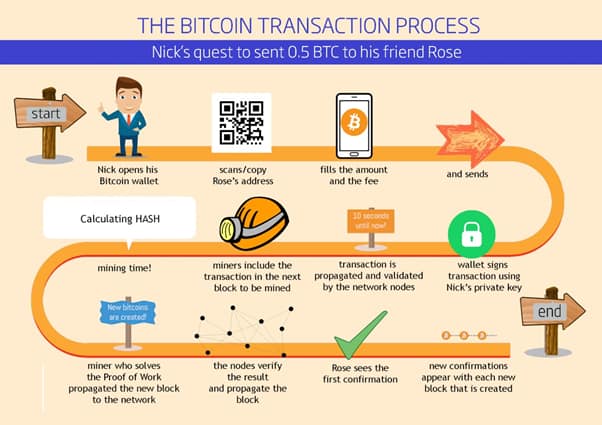

Bitcoin operates on a technology known as a blockchain, a type of distributed ledger enforced by a disparate network of computers. These computers, known as miners, validate and record all Bitcoin transactions by solving complex mathematical problems—a process known as mining. When a block is mined successfully, it's added to the chain of previous transactions, forming the blockchain.

Bitcoin transactions are peer-to-peer, meaning they occur directly between users without an intermediary. Each transaction is digitally signed using cryptographic techniques for security purposes. After a transaction is confirmed by miners, it's irreversible and permanently recorded on the blockchain. Wallets, digital tools where individuals store their tokens, play a crucial role in managing and keeping track of transactions.

Purchasing Bitcoin is simpler than it appears. The first step is setting up a wallet, which can be done through various platforms. These wallets will provide you with a unique Bitcoin address, which will be used for all your transactions.

Next, you can buy Bitcoin through a cryptocurrency exchange. These platforms allow you to exchange traditional currency like dollars or euros for Bitcoin. You need to create an account, fill in your details, and often go through a verification process. Once your account is set up, you can specify the amount of Bitcoin you want to buy and complete the transaction.

After buying, your Bitcoin will be transferred to your wallet. Be sure to keep your wallet secure; if you lose access to it, recovering your crypto can be difficult or impossible. Lastly, remember that the price of Bitcoin can be volatile, so it's crucial to only invest money that you can afford to lose.

Making Sense of Bitcoin: Potential Risks And Rewards

Just like any other investment, Bitcoin comes with its own set of risks and rewards. On one hand, Bitcoin has shown the potential for high returns. For instance, if you had invested just $100 in Bitcoin in 2010, your investment would be worth millions today. Its scarcity and decentralized nature also make it somewhat resistant to traditional inflation, which can make it a potential hedge against economic instability.

However, Bitcoin's value is highly volatile, leading to significant price fluctuations. It's also a relatively new and unregulated market, which can lead to increased risks. Bitcoin's association with illegal activities, due to its anonymity, has also led to increased scrutiny and potential regulatory risks. The same is true with fiat and its association with crime activities, so that argument indeed falls flat on its face.

Remember, investing in cryptocurrency should be done with great consideration and caution. It's still a speculative asset, when compared to traditional finance, it's the new kid on the block.

Bitcoin is a fascinating and complex innovation that has the potential to change how we think about and use money. However, like any other financial decision, investing in Bitcoin should not be taken lightly. It's important to do your own research and understand the risks involved. Whether Bitcoin represents the future of finance or a speculative bubble, only time will tell. Regardless, understanding Bitcoin is increasingly becoming a necessary part of financial literacy in the 21st century.

Matt is the founder of TechMalak. When he's not buried face-deep in the crypto charts you can find him tinkering with the latest tech gadgets and A. I tools. He's a crypto investor and entrepreneur. He uses a mixture of A.I and human thought and input into all his articles on TechMalak, further merging man with machine.