When it comes to investing in cryptocurrency, there's no denying that Bitcoin is the safest and most well-known option. It's been around since 2009 and has established itself as the king of crypto. However, as its market continues to grow, its returns have diminished. I'm not saying Bitcoin isn't highly profitable because it is, I'm saying if you missed investing in BTC early when it was around $1 or a fraction of a $1, it's going to be harder to turn a small sum of money into a lot. This is where investing in altcoins comes in.

Altcoins, or alternative coins, are any cryptocurrency other than Bitcoin. They offer investors the opportunity to get in on the ground floor of a new and exciting web 3.0 project, and the potential for much higher returns than Bitcoin in the short term.

It's important to note that investing in altcoins can be riskier than investing in Bitcoin, as they are less established and have less of a track record for success when compared to Bitcoin. However, for those willing to take on that risk, the potential rewards can be great, because there are some well-establish altcoins that have weathered many crypto winters that are a safe bet.

One way to gain more Bitcoin is to invest in altcoins and then pour those profits into Bitcoin.

This strategy allows you to take advantage of the high returns offered by altcoins, while still maintaining a position in the more stable Bitcoin.

By diversifying your portfolio in this way, you can maximize your potential returns while minimizing your risk.

Altcoins have the potential to be a more profitable investment than Bitcoin in the long term. With altcoins, you have the opportunity to invest in projects that have the potential to disrupt entire industries, and therefore have the potential for much larger returns.

Ethereum which is the king of altcoins, can't even be considered an altcoin any longer. Its massive ecosystem is the driving force behind NFTs, web 3.0, ENS, DeFi, and much more.

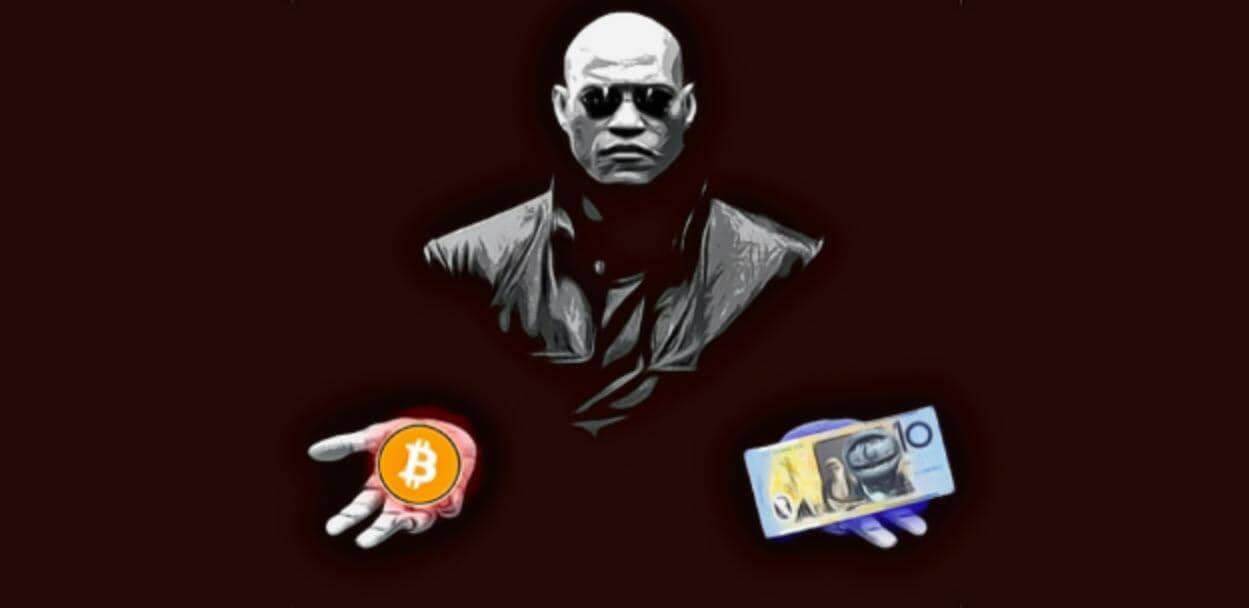

Altcoins Or Bitcoin?

First, let's define the investors who might have different perspectives on this topic.

The first investor might be a risk-averse investor who is looking for a steady and reliable return on their investment.

The second investor might be a risk-taking investor who is looking for high returns and who is willing to take on a higher level of risk.

A third investor might be a long-term investor who is looking to hold onto their investment for an extended period of time by dollar-cost-averaging in and out of the market bottoms and tops.

Altcoins have a lower market capitalization than bitcoin. This means that they have more room to grow in value, and as a result, they have the potential to provide higher returns. For example, if an altcoin has a market capitalization of $50 million with a great use case, it has the potential to reach a market cap of $500,000,000 which represents a 100X return on your investment. Meaning you can turn $1,000 into $100,000. Many projects did that in the last bull run, and many not only did 100X, but 1,000X, and even 10,000X. There are a ton of examples of crypto projects that did that.

This is possible because of the extreme volatility of crypto. Volatility is a feature and it's the price you pay for success in these markets.

If an altcoin has a volatility of 20%, it can provide a 20% return in a single day. On the other hand, if a bitcoin has a volatility of 5%, it can only provide a 5% return in a single day. That's one reason why risk-taking investors might prefer altcoins over bitcoins.

Additionally, many altcoins have a strong community behind them. They have a group of loyal supporters who believe in the project and are willing to hold onto their coins for an extended period of time. This can provide stability to the price of the coin and make it less likely to experience large price fluctuations. This is why long-term investors might prefer altcoins over bitcoins.

It's also worth noting that some altcoins have a specific use case or a real-world application which makes them more valuable, and open to wild speculations.

Another benefit of investing in altcoins is that it allows you to diversify your portfolio.

Diversification is important because it helps you to spread the risk of your investments.

By investing in multiple altcoins, you can reduce your risk of losing your entire investment if one of the coins performs poorly. This is why risk-averse investors might prefer altcoins over bitcoins.

Conclusion

Okay, so here's the thing. Bitcoin is definitely the safer bet when it comes to investing in crypto. It's been around for a while and it's got a proven track record. Entire countries are adopting it as a legal tender.

But, here's the other thing: as more people invest in it, the returns on your investment can start to dwindle unless you have a substantial amount of money to invest in Bitcoin.

So, what a lot of smart investors are doing is investing in altcoins and then using the profits they make from those investments to buy more Bitcoin to hold for the long term.

This way, you're able to get more Bitcoin for your money. And it's not just individual investors who are doing this - a lot of institutional investors are doing it too. So, if you're looking to get in on the next bull run, and you don't have a ton of money to invest, these altcoins could be a smart strategy for you.

Matt is the founder of TechMalak. When he's not buried face-deep in the crypto charts you can find him tinkering with the latest tech gadgets and A. I tools. He's a crypto investor and entrepreneur. He uses a mixture of A.I and human thought and input into all his articles on TechMalak, further merging man with machine.