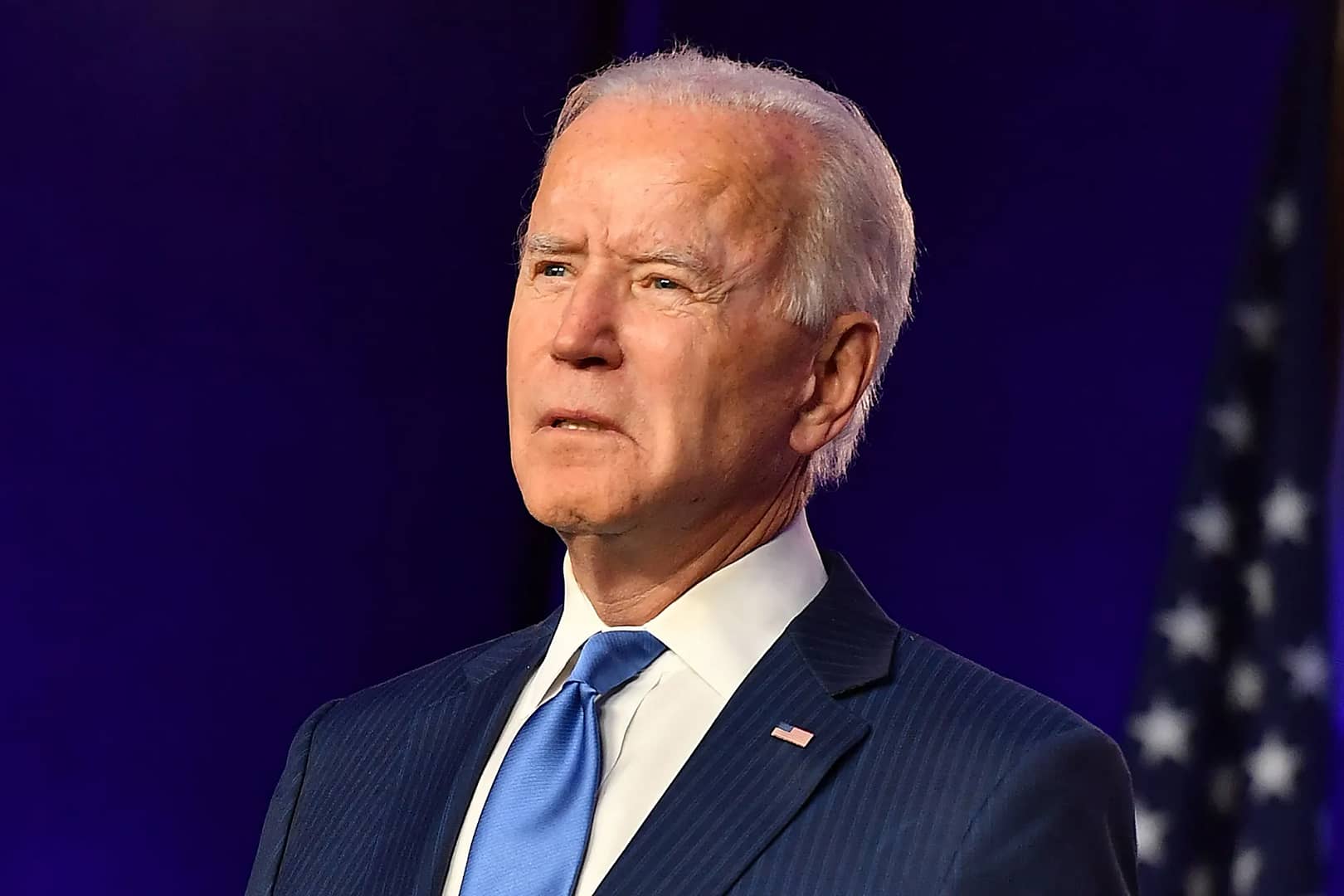

The Biden administration's proposal to change cryptocurrency taxation as part of its budget plan for the 2024 fiscal year has been making headlines. These proposed changes aim to close the tax gap, estimated to be $700 billion over ten years by the Treasury Department. While some experts believe that the changes could discourage innovation and investment in crypto, others argue that they could improve compliance and transparency in the sector. We'll explore some of the proposed changes, why they are being proposed, and how they could affect crypto investors and businesses.

What Are The Proposed Changes?

One of the main changes proposed by Biden is to require cryptocurrency transfers of more than $10,000 to be reported to the Internal Revenue Service (IRS), similar to how cash transactions are reported by banks. This proposal aims to prevent tax evasion and money laundering using crypto assets.

Another change proposed by Biden is to increase the capital gains tax rate for high-income earners from 20% to a whopping 39.6%.

This would apply to those earning more than $1 million per year. This proposal would affect many crypto investors who have seen significant gains in their portfolios over the past year.

Other changes proposed by Biden could impact crypto taxation indirectly. For instance, the proposed elimination of a loophole that allows investors to defer taxes on like-kind exchanges of property could impact crypto investors who have been using this loophole.

Expanding audits for high-net-worth individuals and businesses could also impact crypto taxation, as it could lead to increased scrutiny from tax authorities.

Additionally, creating a global minimum tax for multinational corporations could affect crypto businesses that operate in multiple countries.

Why Are The Changes Being Proposed?

The proposed changes aim to close the tax gap, which is the difference between taxes owed to the US government and those actually paid. The Treasury Department estimates that closing this gap could raise $700 billion over ten years. The proposed changes aim to improve compliance and transparency in the crypto sector, which has been associated with tax evasion and money laundering.

How could the changes affect crypto investors and businesses?

Individual investors could face higher taxes on their crypto profits, particularly if they hold their assets for less than a year. They could also face more reporting requirements and scrutiny from tax authorities. For businesses such as exchanges, custodians, brokers, and miners, the proposed changes could mean more regulatory obligations and costs associated with reporting customer transactions and verifying their identities. These changes could also lead to more competition from foreign jurisdictions that offer lower taxes or more favorable regulations for crypto activities.

Pros And Cons of The Proposed Changes

One of the advantages of the proposed changes is that they could help close the tax gap, which could generate additional revenue for the government. Additionally, the proposed changes could improve compliance and transparency in the crypto sector, making it a more attractive option for investors.

However, one of the disadvantages of the proposed changes is that they could discourage innovation and investment in crypto. Additionally, the proposed changes could lead to increased costs and regulatory obligations for businesses operating in the crypto sector.

Conclusion

Biden's proposal on crypto taxes is not final yet and will have to be negotiated and approved by Congress before it becomes law. While some experts believe that the proposed changes could discourage innovation and investment in crypto, others argue that they could improve compliance and transparency in the sector. As with any changes in tax law, there could be legal challenges or loopholes along the way. It's important for crypto users to consult with tax professionals before making any decisions regarding their assets.

Matt is the founder of TechMalak. When he's not buried face-deep in the crypto charts you can find him tinkering with the latest tech gadgets and A. I tools. He's a crypto investor and entrepreneur. He uses a mixture of A.I and human thought and input into all his articles on TechMalak, further merging man with machine.