Imagine standing at the threshold of a grand event, one that quietly but profoundly reshapes the landscape of digital currency every four years. This spectacle, known as the Bitcoin halving, is not heralded by fanfare or fireworks as you can already tell, yet its impact reverberates through the crypto-verse, influencing markets and mindsets alike. As cryptonauts and casual observers alike gaze towards this digital phenomenon, a countdown begins—a countdown not just to an event, but to an era of renewed speculation, strategy, and perhaps even a bit of digital magic.

The Bitcoin halving countdown marks the calendar like the leap year, a recurring reminder of the ingenious design underpinning the world's first cryptocurrency. With each halving, the reward for mining new blocks is cut in half, a deflationary measure ensuring Bitcoin's scarcity and allure.

As we edge closer to the next halving in 2028, anticipated with bated breath since the last halving, this month on April 19, 2024, the community buzzes with speculation. Will the reduction in block reward upend the mining economy? How will market dynamics shift in anticipation, and what does it mean for the average holder and the newcomer drawn by tales of digital gold?

In the heart of this intrigue lies the countdown to the next halving. It isn't just a measure of time but a beacon drawing minds together, pondering the prospects and potentials of a technology that continues to defy expectations. As we embark on this narrative journey together, let's peel back the layers of the Bitcoin halving, exploring not just its mechanics but also its mythology, its impact, and its indelible imprint on the fabric of financial innovation. Welcome to the countdown, where each tick brings us closer to the next chapter in Bitcoin's unfolding saga.

Understanding the Bitcoin Halving Countdown

Picture this: every four years, a global digital treasure hunt occurs, where the prize gradually shrinks in size. This is not a scene from a futuristic novel but a succinct way to describe the Bitcoin halving event. This phenomenon reduces the reward for mining new blocks by half, meaning miners receive 50% less Bitcoin for verifying transactions. The countdown to this event ticks every four years, drawing attention from every corner of the cryptocurrency world. Some see it as a gala, celebrating the scarcity that adds to Bitcoin's value, while others brace for the impact on mining profitability.

Why does this matter? Imagine if the production of gold dropped significantly overnight. The existing gold would suddenly seem more precious, right? That's the principle behind the Bitcoin halving. It's designed to control inflation by ensuring that the total number of Bitcoins in circulation reaches its cap of 21 million in a gradual and predictable manner. Below is a simplified table illustrating past halving events and their immediate impact on Bitcoin's price:

| Halving Event | Date | Price Before | Price After (approx.) |

| 1st Halving | 2012 | $12 | $120 |

| 2nd Halving | 2016 | $650 | $2,500 |

| 3rd Halving | 2020 | $8,700 | $60,000 |

While past performance is no guarantee of future results, the countdown to each halving event sparks a flurry of speculation, analysis, and excitement across the crypto-sphere. Will the next halving propel Bitcoin to new heights, or will the reduced miner rewards put a damper on the network's security and transaction speed? Only time will tell, but the countdown continues, and the gears of the crypto-world turn in anticipation.

The Impact of Halving on Bitcoin's Value

Every four years, the Bitcoin community witnesses a pivotal event known as the "halving," where the rewards for mining new blocks are cut in half. This mechanism was ingeniously designed to control Bitcoin's supply, ensuring that its issuance follows a predetermined schedule, eventually capping the total supply at 21 million. The anticipation and aftermath of these halvings have historically sparked lively debates and speculations regarding their impact on Bitcoin's value.

The crux of the matter lies in the simple economics of supply and demand. When the reward for mining Bitcoin is halved, assuming demand remains constant or increases, the reduced supply of new bitcoins entering the market can lead to an increase in Bitcoin's price. This theory has been somewhat validated in past halvings, where significant price surges followed these events. However, it's crucial to remember that the crypto market is influenced by a myriad of factors, making it challenging to attribute price movements to a single event.

| Event | Pre-Halving Price | Post-Halving Price (1 Year After) |

|---|---|---|

| 2012 Halving | $12 | $1,100 |

| 2016 Halving | $650 | $2,500 |

| 2020 Halving | $8,500 | $55,000 |

- Reduced miner rewards lead to decreased selling pressure from miners, possibly contributing to a bullish market sentiment.

- The halving acts as a reminder of Bitcoin's scarcity, potentially bolstering investor interest and speculative demand.

Bold predictions and analyses abound in the lead-up to and aftermath of each halving, with stakeholders scrutinizing historical patterns to forecast future movements. While the past performances are no guarantee of future results, they offer intriguing insights into how halvings may influence Bitcoin's value dynamics. As we navigate the complexities and uncertainties of the crypto market, these cyclical events serve as landmarks on the journey of understanding the evolving landscape of digital currencies.

Preparing for the Next Bitcoin Halving

As the clock ticks towards the next Bitcoin halving, a momentous event that slices the reward for mining Bitcoin transactions in half, market participants are on high alert. This expected halving is not merely a technical adjustment; it is a grand spectacle in the cryptocurrency domain, often leading to significant price volatility and increased public interest. To navigate through this epochal event, miners and investors alike must equip themselves with a strategy that both preserves and capitalizes on their digital assets. Understanding the historical context and the potential market reactions is crucial. Embarking on this journey without a plan is like sailing a ship without a compass in tumultuous seas.

Strategies to Consider:

- Optimize Mining Operations: Efficiency is key. Consider upgrading to more energy-efficient mining rigs and exploring renewable energy options to lower operational costs.

- Asset Diversification: Don't put all your bitcoins in one wallet. Look into diversifying your investment portfolio to mitigate risks associated with price volatility.

Moreover, engaging with the vibrant community of fellow enthusiasts can provide insights and forecasts that are invaluable in this preparation phase. Keeping an ear to the ground and eyes on the charts helps in understanding the pulse of the market, making it easier to ride the wave rather than being engulfed by it. Start preparing today; the halving clock is ticking, but so are the opportunities it brings along.

| Event | Date | Expected Impact |

|---|---|---|

| Bitcoin Halving 2024 | April 2024 | Reward Drop & Potential Price Increase |

| Pre-Halving Market Adjustment | April 2024 | Increased Volatility |

What History Teaches Us About Bitcoin Halving Events

The halving events stand out as pivotal moments that shape both the cryptocurrency’s scarcity and its allure. The cyclical occurrence, happening approximately every four years, slashes the reward that miners receive for adding new blocks to the blockchain by half. This mechanism ensures a deflationary attribute, making Bitcoin akin to digital gold. Over the years, these events have sparked widespread speculation, leading to significant market reactions. Observing the trends following each halving, it's evident that although the immediate aftermath is unpredictable, the long-term trajectory tends to lean towards an upward momentum in Bitcoin's value.

- November 28, 2012: The first halving reduced the reward from 50 BTC to 25 BTC. Following this event, BTC saw a gradual but steady increase in its price, underscoring the event's impact on market psychology.

- July 9, 2016: With the reward halved to 12.5 BTC, the aftermath of this event was a testament to Bitcoin's growing stability and adoption, eventually leading to a historic bull run in 2017.

- May 11, 2020: The second most recent halving cut the reward to 6.25 BTC. Despite the pandemic's global economic uncertainties, Bitcoin showcased remarkable resilience and embarked on an unprecedented price surge, highlighting its standing as a 'safe haven' asset.

| Event | Date | Pre-Halving Price | 1 Year Post-Halving Price |

|---|---|---|---|

| 1st Halving | 2012-11-28 | $12 | Significant Increase |

| 2nd Halving | 2016-07-09 | $650 | Stellar Surge |

| 3rd Halving | 2020-05-11 | $8,787 | Unprecedented Highs |

These tables and lists underscore not just the economic implications of each event but also the burgeoning confidence and enthusiasm within the crypto community. Each halving serves as a checkpoint, defying the volatile nature of digital currencies and fortifying Bitcoin's position in the financial landscape. Through these historical snapshots, it becomes apparent that halving events are not merely technical occurrences but pivotal moments that heighten Bitcoin's appeal and validate its foundational principle of limited supply.

2024 Bitcoin Halving

Ever taken a peek at a chart and felt like it’s speaking a bizarre financial language? Let’s unpack that, Bitcoin-style. Imagine you're jamming to your tunes and seeing the sound waves bounce up and down—that's your chart for today, but for Bitcoin.

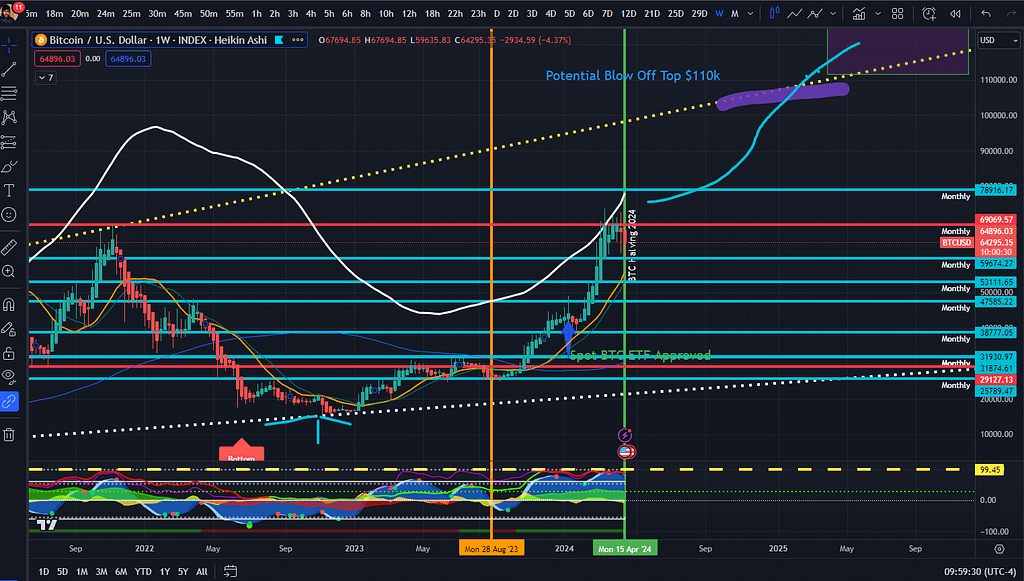

Picture this: On my TradingView chart, I've sketched out a zesty yellow line, zooming straight from the high notes of past Bitcoin price hits. It's kind of like tracking the steepest hills on a roller coaster ride. This line's hinting that if Bitcoin's price scales this hill, it might just touch the sky at around $110,000. Think of it as the peak of the Everest for Bitcoin's price.

But, dear friends, hold onto your hats because it’s not the end of the ride. If Bitcoin, our digital gold, shoots past that $110,000 marker—zoom, off to the races again! Now, let your imagination paint a purple box with a dash of green around the edges. This isn't just any old box; it's a treasure chest showing where Bitcoin could settle next. It whispers of a land where Bitcoin reigns at nearly $200,000.

Remember, though, these aren't precise predictions—they're more like educated guesses based on history repeating its catchy chorus. So as you glance at this chart, think of it as a treasure map, guiding us through the high seas of Bitcoin's price adventure!

In Summary

As the clock ticks down to the next Bitcoin halving in 2028, anticipation fills the air like electricity before a thunderstorm. This event, a coded ceremony set into the very DNA of Bitcoin, promises to be yet another turning point in the cryptocurrency's illustrious life. Whether a novice to the digital currency realm or a seasoned hodler, the halving is a moment of unity, where spectators around the globe watch with bated breath to see how this cryptographic rite will influence the fate of Bitcoin - and, by extension, the broader crypto verse.

As we've explored the paths tread by halvings past and gazed into the speculative future, let's remember, the world of crypto remains as unpredictable as it is exciting. The halving is but a single beat in the heart of a much larger entity, a reminder of the innovation, resilience, and, indeed, the mystery that blockchain technology represents.

Bitcoin's 2024/2025 bull run is in our midst, and with the passing of this year's halving, we look forward to the top of the market when euphoria reaches its peak, and once it does, and believe me it will, we'll enter into a bear market like we always do, in anticipation for the next halving countdown.